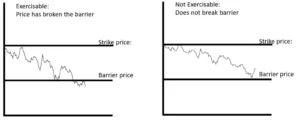

To convert a knockings binary option into a binary call, binary put, one-touch binary call, or one-touch binary put, a barrier (B) must be crossed. If the barrier is not reached before expiry, the strategy returns to zero.

So, if one is long the down and short the binary call, the underlying price must fall to the level of the barrier in order for the barrier to be triggered, and the holder is rewarded with a binary call option.

In binary options, there are six knocks, three down barriers and three up barriers, each defined by the relationship of the strike(K) to the barrier. This section will look at knock-in binary options such as:

- Down and In Binary Call

- Up and In Binary Call

- Down and In One-Touch Call

- Up and In Binary Put

- Down and In Binary Put

- Up and In One-Touch Put

As with all barrier bets, these strategies necessitate a higher level of management because the underlying must be constantly monitored. The directional exposure changes at the barrier, so a down and in call increases in value as the underlying falls towards the barrier, but on touching the barrier, the subsequent binary call option falls in value as the underlying continues to fall, whereas if the underlying bounces off the barrier, the binary call option increases in value. This feature has specific implications for the market-maker who has sold the down and in binary call and the underlying to delta-hedge, because as soon as the underlying hits the barrier, the market-maker will need to buy back the hedge but then purchase more of the underlying to hedge against the subsequent short call position, which is now exposing the book to a rise in the underlying.

The above market-maker issue increases the appeal of knock-in binary options to buyers because if the barrier is set at a support or resistance level, the underlying may aggressively bounce off the support or resistance before a long or short position can be established.

More important articles can be found in my glossary.