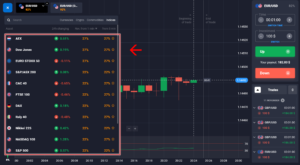

Binary options with two assets are binary structures with two underlying instruments.

The correlation coefficient, Binary Spreads, Double Binary Options, Cubes, and Eachway Cubes will be examined in this section.

The extra variable in asset 2 introduces a new variable, the correlation coefficient of the two assets’ prices*. This necessitates a far more complex examination of the sensitivity analyses, as each strategy, for example, has two deltas, two gammas, and so on. The approach in this sector has been to keep the price of asset 2 constant while the delta of asset 1 is illustrated and analysed, but this also necessitates a constant Rho.

As a result, the reader will encounter a plethora of three-dimensional graphics on the following pages, despite the fact that three dimensions are insufficient.

Binary Spreads and Eachway Spreads are the first two asset binary options to consider. The Binary Spread is the simplest of the two asset binary options to understand because it only has one strike price. The Binary Spread’s simplicity makes it an obvious candidate for retail traders who are already engaged in outright spread trading. The Eachway Spread has two strikes, but they work together, and this strategy is simple to understand.

Because there are now at least two strikes, Double Binary Options require more thought. Double Calls, Double Puts, CallPuts, and PutCalls allow traders to speculate on the independent performance of two assets. When trading the reverse yield spread, for example, a CallPut or PutCall could be the ideal limited risk instrument.

Finally, the final two asset binary options are Cubes and Eachway Cubes, which require the buyer to correctly assess the price ranges that the two assets‘ prices will be in at the option’s expiry. In contrast to the Binary Spread’s relative performance, the focus is once again on the asset’s absolute price.

The author’s experience trading conventional short-term interest rate options suggests that these strategies would be popular in the STIR market.

The additional variables in the aforementioned strategies increase the risk to the market-maker in both pricing and risk management; as a result, a sufficiently wide bid/ask spread would be required to compensate for the extra risk load.

* This correlation coefficient is the variable Rho, which can be problematic because the first differential of an option with respect to the interest rate is also known as Rho. However, because the variables interest rate and asset yield have been studiously avoided in both this book and the precursor, Rho will be limited to the correlation coefficient in this section.

Other important articles can be found in my glossary.