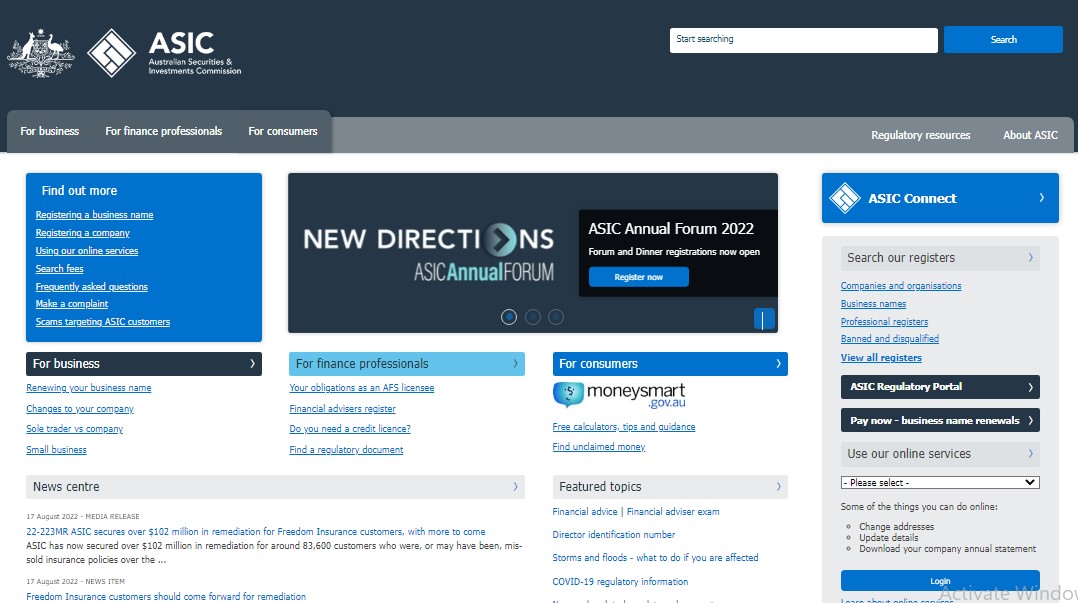

Learn about ASIC Regulation. The Australian Securities and Investment Commission (ASIC) is the primary regulator of financial services and markets in Australia, including registered companies and credit providers. They ensure fairness, integrity, and transparency, which encourages investors and other financial consumers to participate confidently.

The Australian Securities and Investments Commission Act of 2001 established ASIC as an independent Commonwealth governing body. From company registration to data security management, the ASIC body has a wide range of responsibilities and operating power.

It goes without saying that businesses play a critical role in a country’s financial market and services, which is why it was mandated that all businesses operating in the Australian market must be fully compliant with the Australian Securities and Investment Commission. Violations of ASIC requirements and regulations will result in harsh penalties and, in some cases, criminal prosecution.

Australian businesses and companies, as well as foreign-owned businesses, are regulated by the Australian Securities and Investment Commission (ASIC). The ASIC is comprised of a chairperson and members of the body who have been delegated the responsibility of overseeing the performance of the financial system, regulating Australian companies, market organizations, and financial services professionals.

Furthermore, the ASIC enforces laws, maintains a structured record of financial information, and makes it available to the public. They also grant financial licences to businesses operating in Australia.

ASIC’s Role: The Australian Securities and Investment Commission (ASIC) plays a critical role in the financial system. The ASIC has jurisdiction over a variety of issues, including regulation, enforcement, and facilitation.

asic.gov.au

The ASIC’s key roles under the ASIC Act include:

- Improving, facilitating, and maintaining overall financial system performance

- Promoting and assisting investors and other financial consumers in making secure and informed decisions.

- Maintaining trust and confidence in the financial system by educating investors and the general public about investor responsibilities. Enforcing laws efficiently and ensuring that procedural requirements are met.

- Assisting in the imposition of civil and criminal penalties, as well as the commencement of prosecution

- Increasing financial system transparency by participating in market supervision and corporate governance.

- Investigating potential violations and issuing infringement notices

- Individual financial market activities are prohibited.

- Intervene in the process of issuing defective products.

ASIC is more than just a regulatory body; it is also backed by the law, with new amendments in 2019 authorizing civil and criminal penalties for companies or investors who fail to follow ASIC regulations and guidelines.

Despite the fact that the Australian Securities and Investment Commission (ASIC) is primarily concerned with financial services. The body also has clout and clout in every aspect of Australian business, as well as any other foreign-owned business operating in the Australian financial market. From taking credit card payments from an Australian to registering a company in Australia, the Australian Securities and Investment Commission (ASIC) is responsible for setting the minimum standard for financial system security and fairness.

ASIC regulates who?

The Australian Securities and Investment Commission (ASIC) licences and regulates all financial service businesses in Australia, including Australian corporations, foreign-owned businesses, financial service organizations, and financial professionals. In accordance with the National Consumer Credit Protection Act of 2009, they also serve as consumer credit regulators, licencing and regulating organizations such as financial firms, banks, mortgage brokers, and credit unions.

The ASIC exists to ensure that these financial service businesses are transparent and that their business transactions are honest. They are also in charge of regulating the creation of new markets in the Australian financial system, as well as participating in the authorization process for these new markets.

While the ASIC’s primary focus is on financial services businesses, their authority extends to every other industry. The Australian Securities and Investment Commission (ASIC) will regulate the business at some point as long as it has a presence in the Australian market.

What impact does ASIC have on you?

The Australian Securities and Investment Commission is in charge of laws that affect every Australian citizen’s life. Their authority spans finance, investments, insurance, and banking. Some of their responsibilities include appointing auditors to banks and other financial institutions in order to establish a reasonable standard and ensure creditors deal fairly with borrowers. ASIC rules must be followed by approximately two million companies and businesses in the country, as well as entities of top banks. The Australian Securities and Investment Commission has also stepped up its efforts to protect data within the country. The goal is to ensure that foreign businesses are committed to protecting Australian citizens’ personal and financial data. Failure to do so will result in severe penalties and, in some cases, criminal prosecution.

Summary of The ASIC Regulation

In general, the Australian Securities and Investment Commission (ASIC) exists to protect consumers and investors in the financial system, as well as to educate them about their options.

They offer financial education resources, including information on borrowing safely. Financial professionals can also find information on how to apply for auditor registration and how to obtain an AFS licence, which is required to operate a financial services business.

Furthermore, consumers can learn how to recover money from forgotten bank accounts, shares, insurance policies, and other assets. They can also be advised on what to do if a company in which they have invested goes bankrupt.